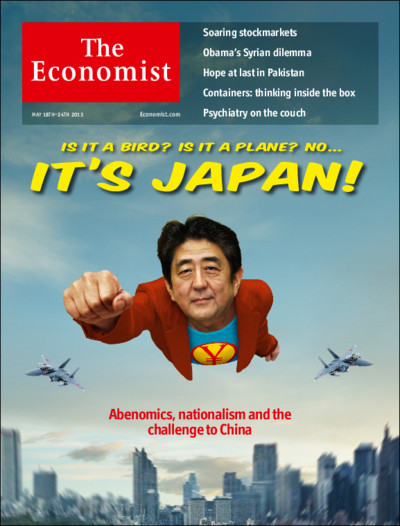

(Mug)abenomics and more central bank news

The Economist posted the Japanese prime minster on its cover this week wearing a superman custom. It is quite stunning how educated people can conclude Abenomics to be a success. All it boils down to is doubling the money supply in two years. What should happen to financial assets under these circumstances? If twice as much money is chasing the same amount of stocks, stocks should go up(nominally). They do. Due to supply explosion, the currency itself is declining rapidly and so are the bonds. At the end of the day, the Japanese government will reach a point where it will not be able to service its debt any longer as it owes 24 times its annual tax revenues. When we reach this point, I suspect the Superman cape to come off and comparisons with Mr. Mugabe in Zimbabwe to appear. In the meantime, feel free to party along the Japanese stock market but make sure you stay close to the emergency exit in case a fire breaks out.

As for a brilliant seven minute view on the current fiscal state of Japan, listen to Kyle Bass below.

http://www.cnbc.com/id/100762194

Bernanke

This week we also heard from Federal Reserve Chairman Ben Bernanke as he testified before Congress. I found his statement regarding inflation rather interesting.

BERNANKE ON INFLATION BEING TOO LOW:

“I would point out that even though we have a dual mandate, that inflation if anything is a little bit too low. Inflation has been very low; the dollar has been strong. We have not in any way failed on that responsibility.” http://money.msn.com/business-news/article.aspx?feed=OBR&date=20130522&id=16510293

As far as I know it is the Federal Reserve’s primary mandate to preserve price stability via lowest possible loss of purchasing power. While I don’t think that inflation is low I would like to know why slowly rising prices are a problem rather than the fulfillment of the Federal Reserve’s mandate.

Fisher

Dallas Federal Reserve president Richard Fisher made many great points this week in an interview he gave on Monday. Fed’s Fisher Says U.S. Fiscal Policy Hampering Job Growth http://www.bloomberg.com/news/2013-05-20/fed-s-fisher-says-u-s-fiscal-policy-hampering-job-growth.html .

Mr. Fisher has often argued for a more pro-business approach in government and for policy makers to get the budget deficit under control. I was rather encouraged by his remarks until I found out that his appeal for budget control does not extend to the Federal Reserve itself. According to Bloomberg, Fed System’s Budget to Grow 8% in 2013 as Regulation Expands http://www.bloomberg.com/news/2013-05-23/fed-system-s-budget-to-grow-8-in-2013-as-regulation-expands.html . It appears that asking others to tighten their belt is more enticing than doing so oneself. Below you can see the salary increases at the Federal Reserve:

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2013/05/Fed%20Wages_1.jpg

Now, I understand why the Federal Reserve sees an improving economy in America…

There is hope after all

If you are discouraged by the black clouds surrounding this article, there is a ray of hope in the central banking community after all. German Bundesbank president Jens Weidmann has actually come out and defended sane monetary policy. He speaks clearly against money printing in Europe and had the following to say regarding “Abenomics”:

“I wish the Japanese good luck in their experiments,”Weidmann, who also heads Germany’s Bundesbank, said in Paris last night. “We see that monetary policy can be pushed into a very difficult spot.”…..” “The Japanese central bank buys 70 percent of the emissions of the government, I am just telling you, I am not commenting,” said Weidmann, who has also criticized the ECB’s pledge to buy government bonds if certain conditions are met.

“What concerns me” is “not fully visible yet,” he said, adding he’s worried that monetary policy is being asked to solve Japan’s problems at the expense of fiscal and structural reforms.

“I’m not saying this is what is happening. This is my concern.” http://www.bloomberg.com/news/2013-05-23/ecb-s-weidmann-wishes-japan-good-luck-with-experiments.html

As so often I close with a fitting quote by a great statesman:

Government is not reason, it is not eloquence – it is a force! Like fire, it is a dangerous servant and a fearful master; never for a moment should it be left to irresponsible action.

– George Washington

Tx for the insights, Rich !

Can’t get enough Godfrey Bloom. BTW don’t forget to put your bid in to have lunch with Warren Buffet- auction is tomorrow. NOT!